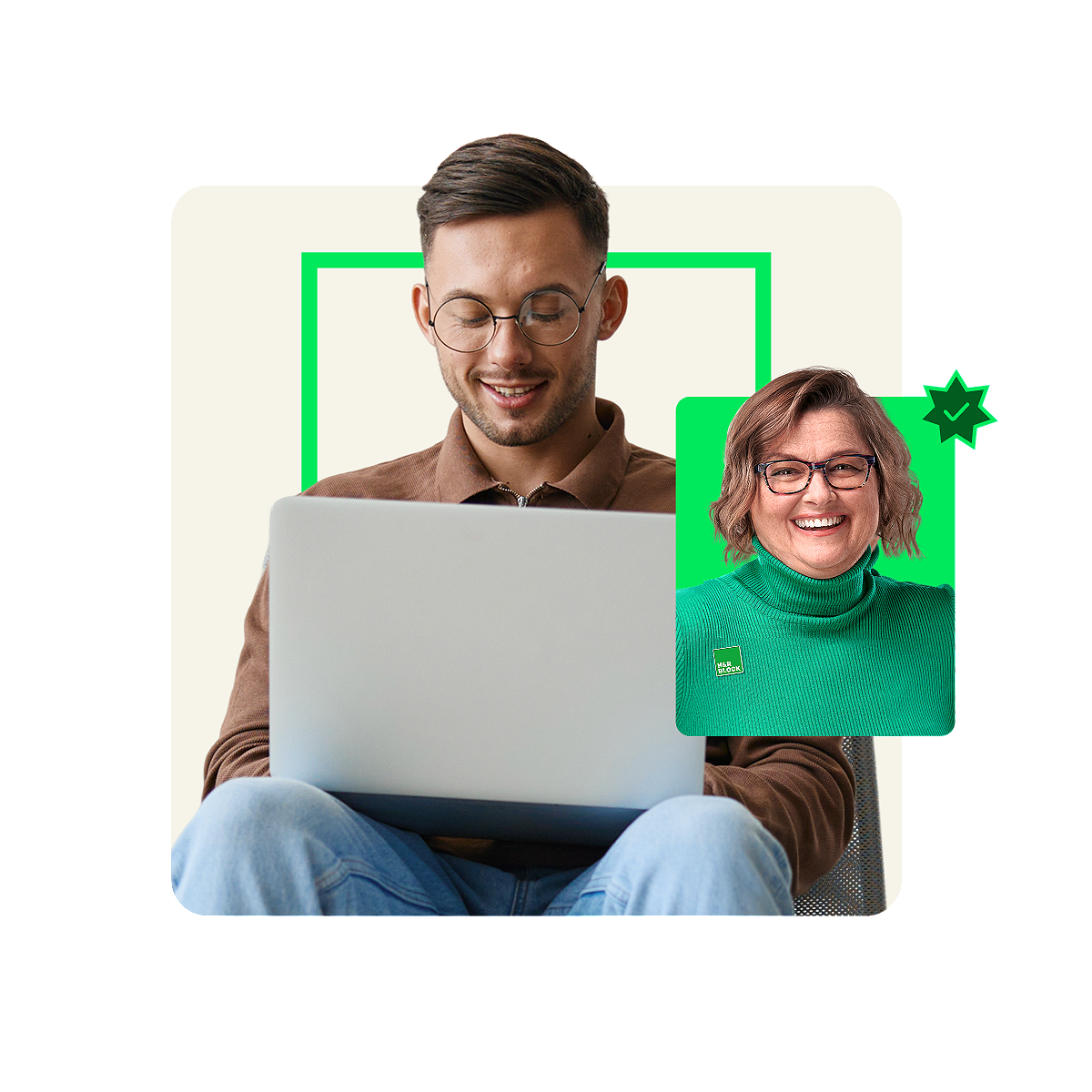

Get a pro to review your work for free

For a limited time, new clients can add Tax Pro Review to any of our paid do-it-yourself tax prep options at no extra cost. See offer details

However you earn income, H&R Block can help you claim every possible credit and deduction and file with confidence.

Online support from live tax pros and AI Tax Assist.

Full, personalized support from home, in person, or both.

H&R Block Online

Awarded “Best Overall” online tax service

2025 CNET Editor’s Choice Awards

“We chose H&R Block as our best overall online tax service because of its transparent pricing, easy-to-use platform, and standout AI assistant making it this tax season’s newly crowned top choice for most tax filers.”

For a limited time, new clients can add Tax Pro Review to any of our paid do-it-yourself tax prep options at no extra cost. See offer details

From full-time work to part-time gigs, we’ve seen it all, and we have the tax prep options to prove it.

We’ve put together the most common forms for rideshare and delivery drivers. Use our checklist to make sure you’re ready to go for tax prep.

If you received enough money from digital platforms like PayPal, Etsy, Venmo, etc., your taxes may look a little different this year.

File on your own and get all your questions answered with unlimited expert help.

Not sure what you can and cannot deduct? Consider these common deductions for a variety of different gigs.

Common deductions:

Common deductions:

Common deductions:

Not sure how to handle tip income, 1099-K requirements, or other recent tax law changes? H&R Block can help.

“I have both a full-time job and a significant side gig. My tax pro understands my situation. She found deductions I was unaware of and kept me informed throughout the process. I have used H&R Block for several years, always with great results and service.”

Small business client

March 2025