Software updates

We make periodic updates to our tax software to reflect the latest changes from the IRS. If you own H&R Block software, it’s easy to install tax software updates.

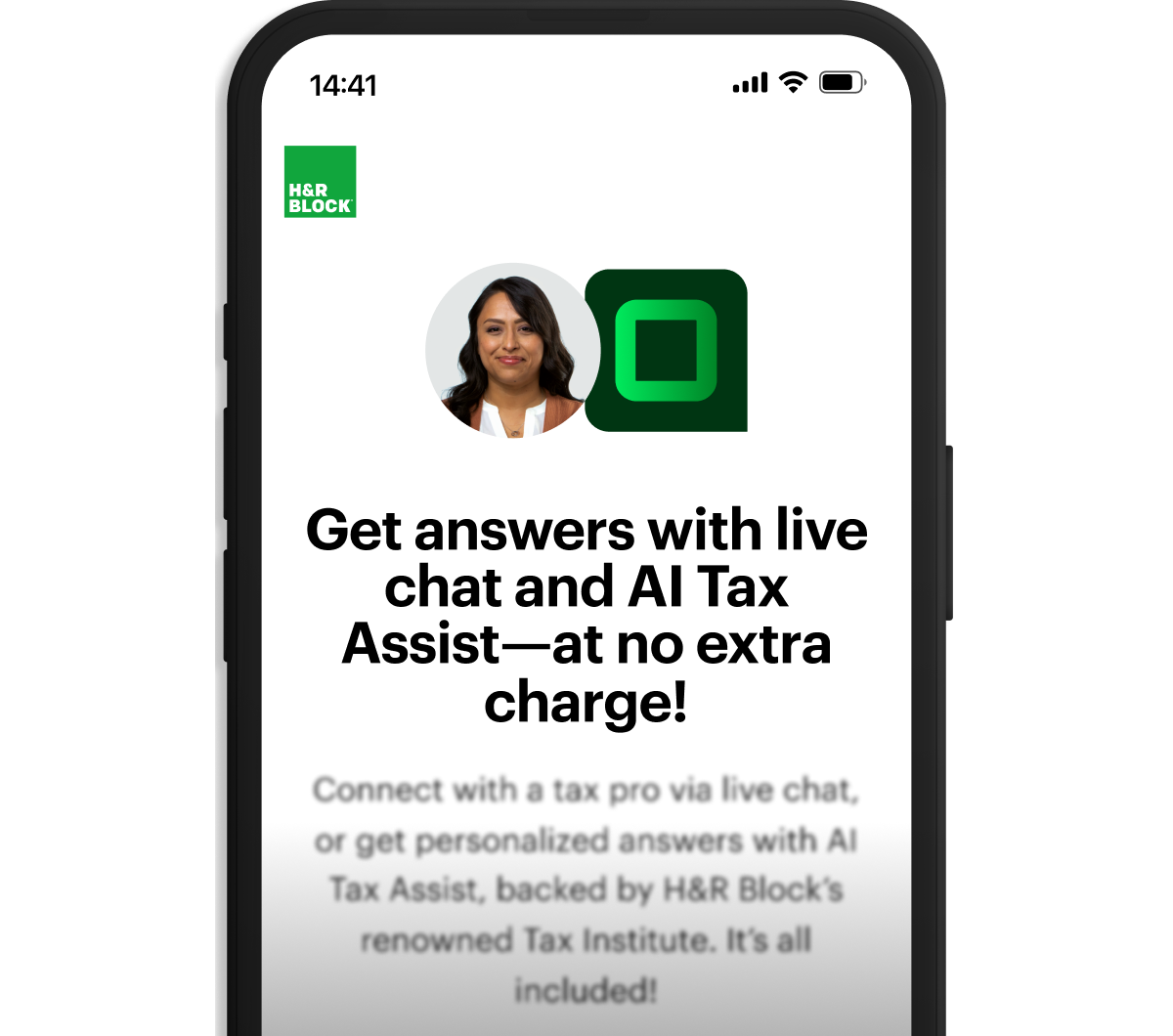

Premium now features AI Tax Assist, backed by H&R Block’s proven knowledge. File complex returns with ease and get five federal e-files.

Premium is best for:

Freelancers and rental properties

Complex returns

You’ll get your maximum refund with H&R Block. Find a bigger refund somewhere else? Your tax prep is free.

Unhappy with our tax software for any reason before you file? We’ll refund your full purchase price.

If the software makes an error, we’ll reimburse you for any resulting penalties and interest up to a maximum of $10,000.

Surprises aren’t always good. With H&R Block, you’ll know the price before you start your taxes. You can count on it.

Backed by H&R Block’s tax expertise, our AI Tax Assist puts expert knowledge, round-the-clock guidance, and refund-boosting support all in one place.

Auto-renew today to lock in this year’s price for next year’s software. Plus, get Tax Identity Shield® for free.

Premium |

||||

|---|---|---|---|---|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Simply download your tax software to get started. We walk you through every step of the way.

Doing taxes always means preparing one federal return. With our tax software, you get five federal e-files!

Import last year’s tax return data from TurboTax in just seconds.*

*Refers to TurboTax .tax file import; .pdf import time varies based on internet and system speed.

When you file your return, you can expect the biggest refund possible.

You trust us with your most important information and documents, and we take that responsibility very seriously.

We’ll provide representation by your side every step of the way — at no extra charge, guaranteed.

We make periodic updates to our tax software to reflect the latest changes from the IRS. If you own H&R Block software, it’s easy to install tax software updates.

Need to file a past return? We’ve got you covered with prior-year software editions for federal and state taxes.

Gather your docs and let your tax pro do the rest. Just review and approve your return. Meet in an office or via chat, phone, or video.

File from your smartphone or computer. Get guidance every step of the way.

Tax help included in Deluxe, Premium, and Self-Employed do-it-yourself products.