New tax law changes may affect deductions, credits, and more. Find out what’s different and what it means for you.

TAX CALCULATOR

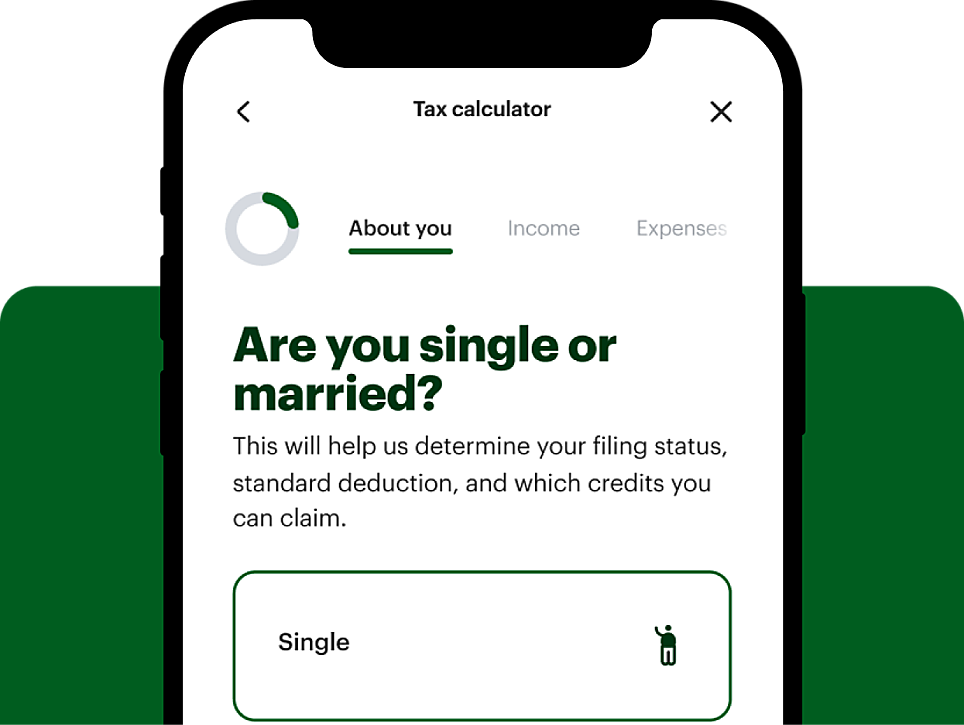

Get a clear estimate with our tax calculator

Know what to expect this tax season with our tax refund estimator, now supporting the 2025 OBBBA tax law changes.

How the tax calculator works

Answer a few simple questions for a quick estimate

Share details about dependents, income, and deductions for a better result

Stress less about tax season with your estimate and custom tax doc checklist

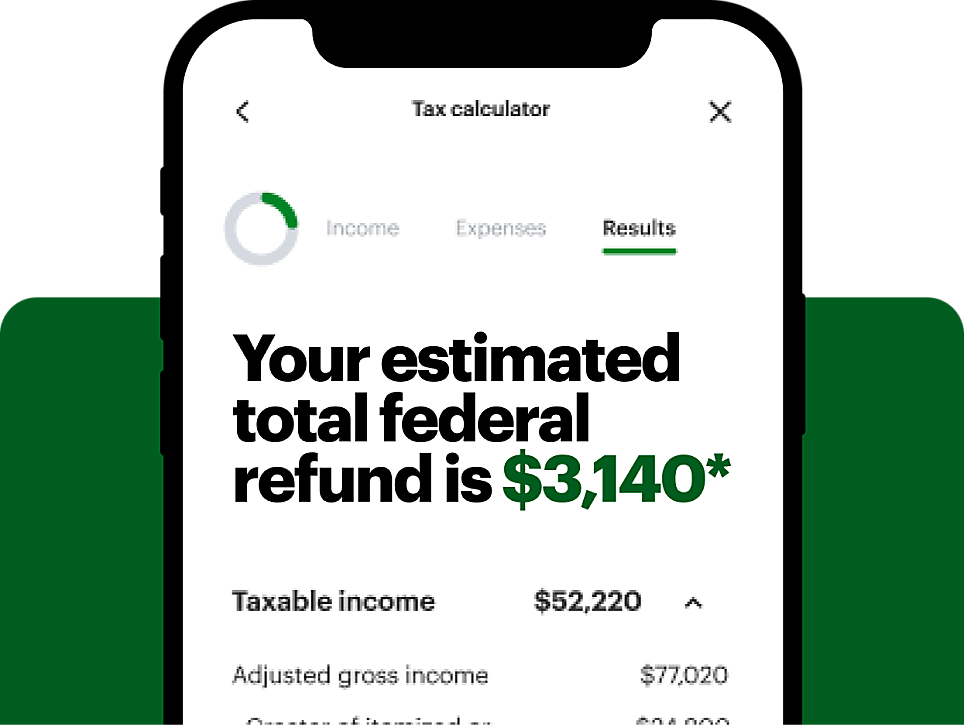

Understand what goes into your tax refund

Deductions are used to lower your taxable income, while tax credits are subtracted from the amount you owe.

Your tax bracket is determined by your taxable income and filing status. Our tax refund calculator will show you how.

Explore other tools

W-4 withholding calculator

Use our W-4 tax estimator to change your withholdings at any time.

Tax prep checklist

Create your own checklist by answering a few quick questions.

Choose how you want to file — on your own, with expert help, or we’ll do it for you

Approximately 52% of filers qualify for H&R Block Online Free Edition. Simple tax situations only (Form 1040 and no schedules except Earned Income Tax Credit, Child Tax Credit, Student Loan Interest, and Retirement Plan Distributions). Learn more

File on your own with confidence

Nearly 52% qualify for free — easy guided steps for simple returns.

- Great for W-2, students, or unemployment income

- Upload docs from any device

- Learn more

File online with help by your side

Online support from live tax pros and AI Tax Assist.

- Great for families, freelancers, or investors

- Accuracy and ease from start to finish

- Learn more

File stress-free with a tax pro

Full, personalized support from home, in person, or both.

- Taxes prepared by an expert in as little as one hour

- Choose your pro or get matched based on your needs

- Learn more

FAQs

The tax calculator now provides fields for you to include your tips deduction, overtime deduction, senior deduction, and auto loan interest deduction, as well as updates to the standard deduction amounts, Child Tax Credit max per child, and state and local taxes deduction.

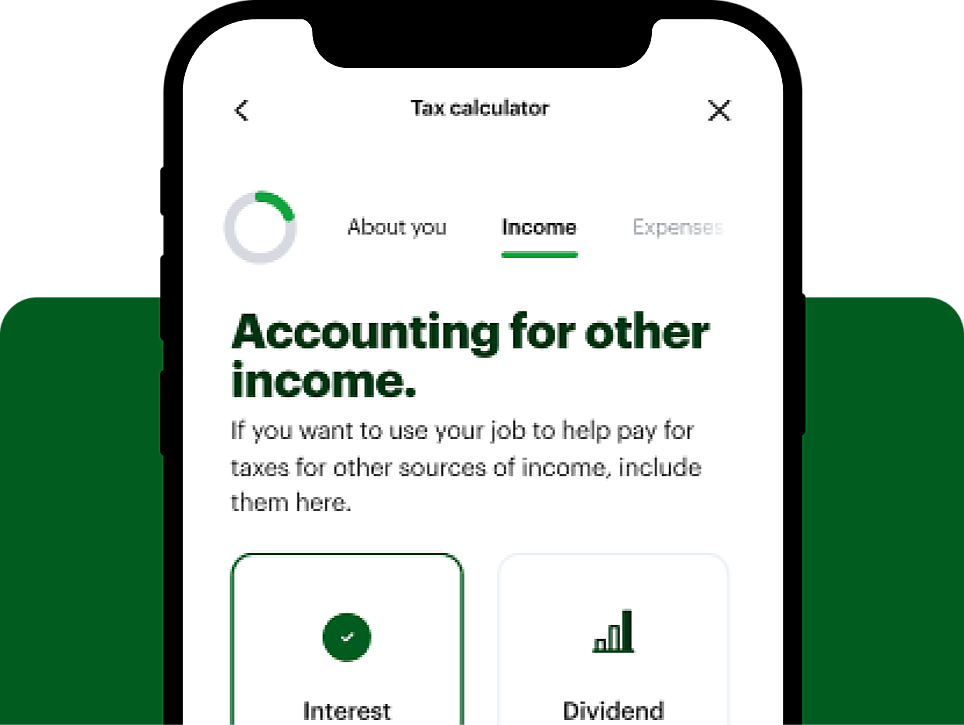

To use the tax calculator be sure to have estimates on hand for any income you received, including from a job, small business, interest, dividends, stocks, and more. You’ll also be asked about dependents and deductions. The more information you provide, the more accurate your estimate will be.

The tax calculator estimates your refund or taxes owed based on your income, deductions, and credits.

You may be able to reduce what you owe depending on the type of income you have. Based on the info you provided, the tax calculator will give feedback on how you can reduce a balance due to the IRS.

H&R Block’s tax calculator only estimates federal taxes.

Several factors can affect your tax refund, including your types of income, amount of income, how much of your income was withheld for taxes, any estimated tax payments made, if you have dependents, and more.

You can use your tax refund estimate to help you determine if you need to change the amount of tax withheld from your income or look for other ways to lower your taxable income. Knowing your tax refund estimate can also help you plan for payments or extra income in advance.

You need to file your tax return before receiving your refund. The IRS generally starts accepting tax returns at the end of January, but the exact date changes year to year. After your return is accepted by the IRS, you can check the status of your refund by going to the IRS’s refund tool here.

Use the tax refund calculator before you file your taxes to help you plan for payments or extra income in advance. Knowing your tax refund estimate also helps you determine if you need to change the amount of tax withheld from your income or look for other ways to low your taxable income.